Just because we bowlers took the week off doesn’t mean your intrepid reporter took the week off! As we are sort of at the halfway point of our season, this might be a fun time to take a look back at our first four months and review some highlights (and lowlights?).

I commented to Frank D at our last session that on any given Tuesday any one of us can get hot and bowl a great series, and any one of us can get stone cold, too. For example, take me with a season average of 179 — a high series of 627 and a low series of 471. That’s a difference of 159! Or take Dave Smith, whose season average is 95 — with a high series of 361 and a low series of 206. That’s a difference of 155. The biggest spread, though, goes to the Professor, Ed Schechter. His average is 148, with a high series of 508 and a low series of 317, for a spread of 191. Next was Ed Smith, who had a high series of 598 and a low of 411. Our most consistent bowler has been Mike Ryan, with a spread of “only” 65.

Even game to game within any given day, we have highs and lows. The good news is that eight of us have bowled at least one 200 game this season, and another had a game in the 190s. That’s great! That includes both Tom and Ted bowling games in the 250s on the same day. We’ve had nine bowlers roll a 500 series, one who crossed the 600 mark, and one who missed that mark by just two pins. At our session next week, the weekly updated list of averages will show all of this data.

And finally, we’ve had 14 different Bowlers of the Day, which means that the wealth has been spread around very nicely and allows hope to indeed spring eternal for all of us week to week.

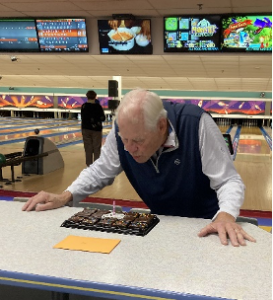

What gives me the greatest pleasure is how our group has grown! We now consistently need three pairs of lanes because we have at least 11 bowlers join us just about every week. And that’s happening even as five of us have been absent nursing injuries and ailments of various kinds. Let’s hope you guys will be back soon. Wouldn’t it be something if I had to go to Ben at the front desk to ask if he can give us a fourth pair of lanes! In addition, the address list on the weekly reports includes a few bowling “alumni,” who are welcome back anytime even if just to say “hi.” Moreover, there are a few guys on the email list who have expressed interest in coming to bowl at some point, to whom I say: “the future is NOW!” Right, Doug? Right, Steve? I’m sure that the second half of our season will every bit as enjoyable as the first.

Happy new year to all.